동북아역사재단 2023년 09월호 뉴스레터

- Jo Myung-geun, Professor of History at Yeungnam University

The Choice of Japan as a Late Capitalist Country: Building a Financial System for State-Led Economic Development

Large-scale mobilization of funds was essential in modern capitalism, and banks were the typical institutions responsible for this. As a late capitalist country, Japan needed to develop capitalism as quickly as possible but then realized the difficulties of doing so with private capital alone. In situations of limited access to private capital, the Japanese government established various specialized financial institutions around the 1900s to facilitate state-led capitalist development. These specialized financial institutions were banks established by special laws for specific purposes, each established by its laws or ordinances. These institutions were designed to manage long-term funds or cater to specific sectors like agriculture, industry, and trade, handling operations that were challenging for conventional banks to effectively oversee.

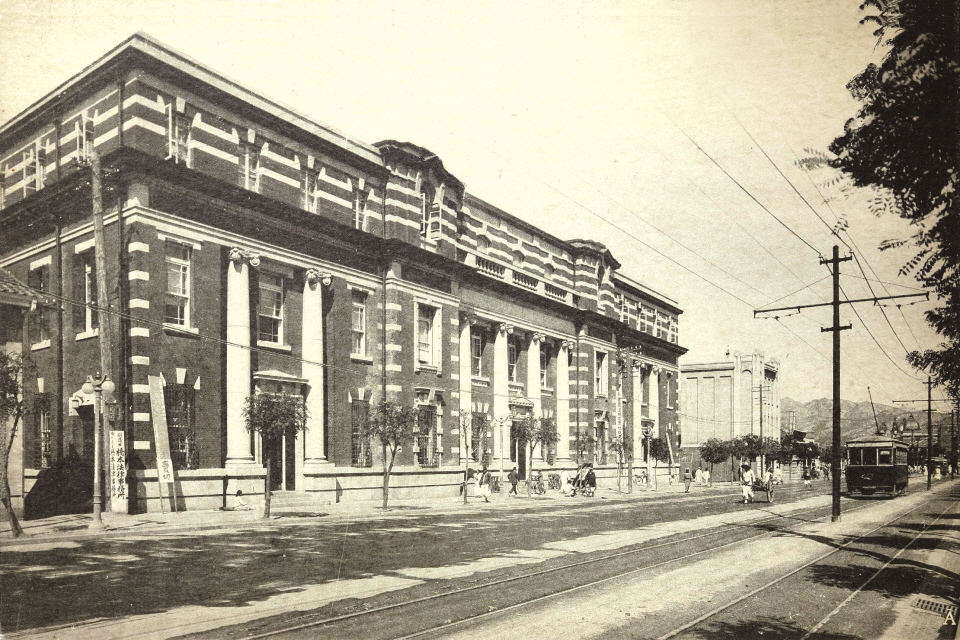

Building a colonial financial system

After the forced ‘annexation’, the Japanese empire restructured the financial system in colonial Joseon during the 1910s, and the basic framework was completed by 1918. In those days, financial institutions were largely divided into specialized financial institutions established by special laws and general banks governed by the 「Banking Ordinance」. The specialized financial institutions were composed of the Bank of Chosen, an issuing bank; the Chosen Siksan Bank and the Oriental Development Company, which provided long-term industrial financing; and financial associations, which were in charge of social policy funds. In other words, the specialized financial institutions were established to perform specific tasks. For example, the Bank of Chosen served as a central bank, issuing banknotes and handling national funds. The Chosen Siksan Bank was responsible for industrial financing focused on agriculture and industry. The financial associations catered to rural small landowners and urban merchants. Furthermore, the establishment of general banks also progressed after the enactment of the 「Banking Ordinance」, and by 1920, there were 20 operating general banks.

Colonial Distortions in Modern Finance: Hypertrophy of Specialized Financial Institutions and Stagnation of General Banks

The financial system in colonial Joseon formally adopted the Japanese system, with a division of labor between specialized financial institutions and general banks. However, colonial Joseon differed from Japan in that it allowed specialized financial institutions to engage in the operations of general banks. In Japan, mutual development was enabled under the division of labor system between specialized financial institutions and general banks. In contrast, when it comes to colonial Joseon, a different standard from Japan was applied, on the grounds that general banks were not developed enough, so specialized financial institutions had no choice but to engage in their operations. Consequently, the Bank of Chosen, which held the privilege of issuing banknotes, and the Chosen Siksan Bank, which could issue bonds up to 15 times its capital, inevitably encroached on the business of general banks. In essence, general banks, reliant only on private deposits, were at a disadvantage in competition with specialized financial institutions that held privileges such as banknote issuance and bond issuance. As a result, general banks lagged behind specialized financial institutions in terms of the composition of deposits and loans by total financial institutions.

How Much did the People of Joseon Benefit from Modern Finance during the Japanese Colonial Period?

The phenomenon of customers being segregated by ethnicity based on the founding entity of the banks was prominent in the general banks during the Japanese colonial period. Joseon-owned banks mainly served Joseon people, while Japanese-owned banks focused on Japanese customers.

Thus, Joseon-owned banks, especially those in local areas, contributed significantly to the supply of funds for local Joseon capitalists. Considering these factors, we can see that the stagnation of general banks creates a very unfavorable environment for the growth of Joseon capitalists.

Meanwhile, modern financial institutions expanded during the Japanese colonial period, but access to them for Joseon people was highly limited. The majority of Joseon people were poor, economically vulnerable farmers. They had no choice but to rely on usurers, paying extremely high-interest rates that often reached 50%. While most people of Joseon had to depend solely on usurious financial entities, some wealthy individuals could borrow money from modern financial institutions at low-interest rates and lend it out at higher rates, leveraging it in various ways to accumulate their wealth.

동북아역사재단이 창작한 '일제강점기 화폐제도와 금융' 저작물은 "공공누리" 출처표시-상업적이용금지-변경금지 조건에 따라 이용 할 수 있습니다.